The crypto market faced a sharp selloff overnight as renewed trade conflict fears between the United States and the European Union shook global risk sentiment. Bitcoin and major altcoins reversed recent gains, with traders reacting to fresh tariff headlines and the possibility of escalating economic retaliation on both sides of the Atlantic. While crypto is often viewed as a separate market, this move once again showed how quickly digital assets can behave like high-beta risk trades when macro uncertainty spikes.

Related Reading

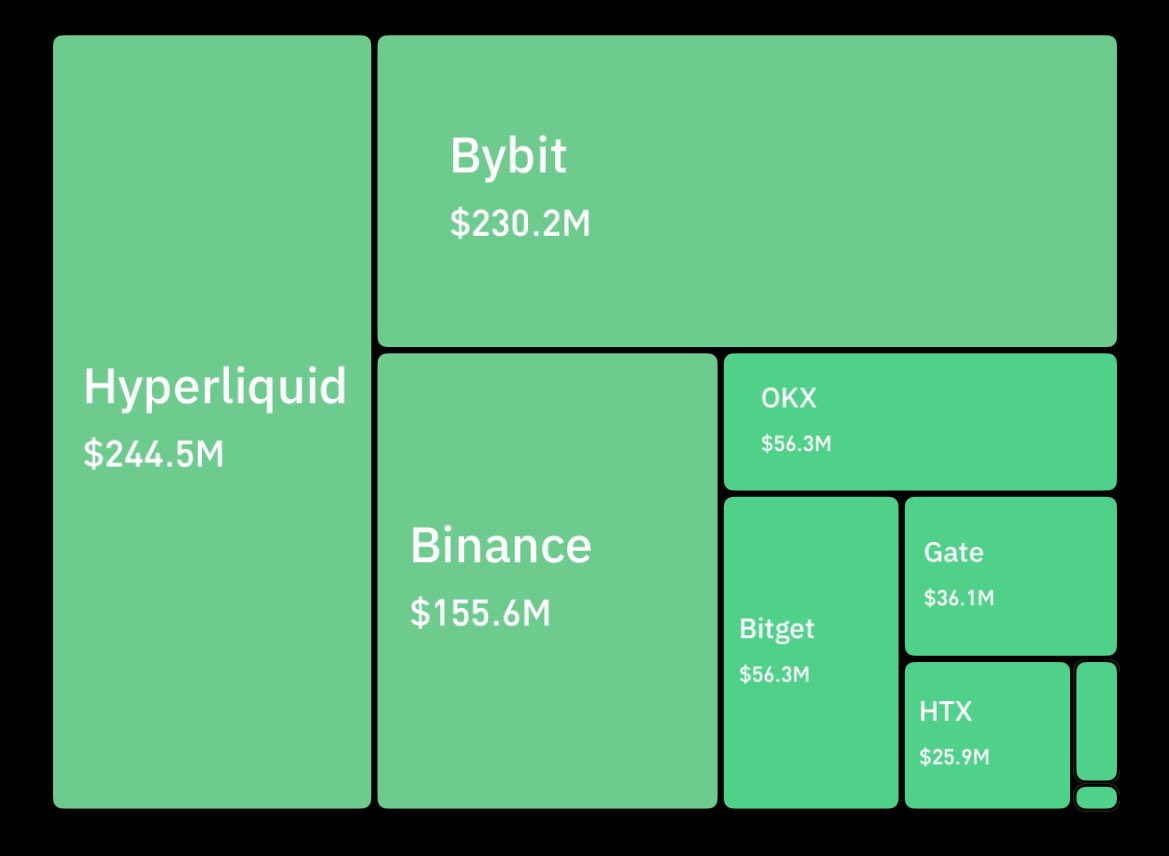

According to analyst Darkfost, the liquidation impact was immediate and aggressive. More than $800 million worth of leveraged positions were wiped out in a matter of hours, including roughly $768 million in long liquidations. The scale of long closures suggests that traders were positioned for continuation to the upside, but were caught offside as prices rolled over sharply.

What stood out most was where the damage occurred. Darkfost noted that Hyperliquid recorded the largest share of forced liquidations, with $241 million, while Bybit followed closely with $220 million. The wave of liquidations appears partly tied to the announcement of new tariffs targeting Europe, which triggered an equally fast response from EU policymakers, reigniting the broader “trade war” narrative across markets.

CME Opens the Door to Fresh Volatility

Darkfost warns that the timing of this selloff matters as much as the liquidation size. As soon as CME trading opened, Bitcoin saw a sharp downside move, suggesting that institutional flows and macro-linked positioning played a direct role in the shakeout. In past risk-off episodes, the CME open has often acted like a volatility trigger, especially when markets are already fragile, and leverage is elevated across major exchanges.

This is why the next few hours are critical. The same type of move could easily repeat at the opening of the US markets, where liquidity conditions and headline sensitivity tend to amplify reactions. If sellers press again, the market could see another cascade of forced closures, particularly in high-beta altcoins that remain vulnerable after the overnight wipeout.

Related Reading

The message is straightforward: stay cautious and avoid overexposure to leverage while the macro backdrop remains unstable. Liquidations can create sharp bounces, but they can also reset momentum quickly if fear spreads across risk assets.

Darkfost adds that attention should remain on incoming political updates. The market is now trading the narrative, not just the chart. Further statements could arrive at any moment, and as history has shown, Trump often delivers market-moving headlines right in the middle of the weekend.

Bitcoin Holds Fragile Rebound As Crypto Tests Macro Nerves

Bitcoin is trading near $93,100 after a sharp rejection from the $96,000–$97,000 supply zone. The chart shows BTC still struggling below key moving averages, with momentum capped by the declining blue trendline overhead. This reinforces the idea that the latest upside attempt was more of a rebound than a clean trend reversal.

Structurally, price is forming higher lows after the violent breakdown from the $110,000 area. However, the rebound remains vulnerable as long as BTC stays trapped beneath resistance and fails to reclaim the mid-$90,000s with conviction. The recent candles also highlight hesitation, with wicks suggesting aggressive selling into strength.

Related Reading

The red long-term moving average is rising near the low-$90,000s, acting as a potential dynamic support zone. If Bitcoin holds above that level, it keeps the recovery structure intact and prevents a deeper reset toward prior liquidity pockets.

This matters for the broader crypto market. When BTC remains range-bound under resistance, altcoins usually struggle to sustain rallies and become more sensitive to liquidation-driven volatility. Risk appetite can return quickly, but it requires Bitcoin to break above resistance and hold. Until then, crypto remains in a fragile stabilization phase, not a confirmed bullish continuation.

Featured image from ChatGPT, chart from TradingView.com