The Department of Justice has opened a criminal investigation into Federal Reserve Chair Jerome Powell — and the bitcoin price is reacting. The investigation is intensifying a months‑long feud between the White House and the U.S. central bank

According to Powell, the DOJ served the Federal Reserve with grand jury subpoenas and threatened a criminal indictment tied to his June 2025 testimony about a $2.5 billion plus renovation of Fed office buildings.

Powell characterized the move as politically motivated, claiming it reflected pressure from the Trump administration to cut interest rates more sharply than the Fed’s data‑dependent stance.

President Donald Trump has publicly criticized Powell’s performance and denied direct involvement in the DOJ action, though he has reiterated his dissatisfaction with the Fed’s monetary policy. The widening dispute has rattled traditional markets, with U.S. stock futures sliding and safe‑haven assets like gold and silver surging to record levels.

This episode represents somewhat of an escalation in institutional tensions. Powell’s critics argue the DOJ’s action is valid and undermines the Federal Reserve’s independence, while defenders of the Fed emphasize the importance of insulating monetary policy from politcs.

Bitcoin price reaction

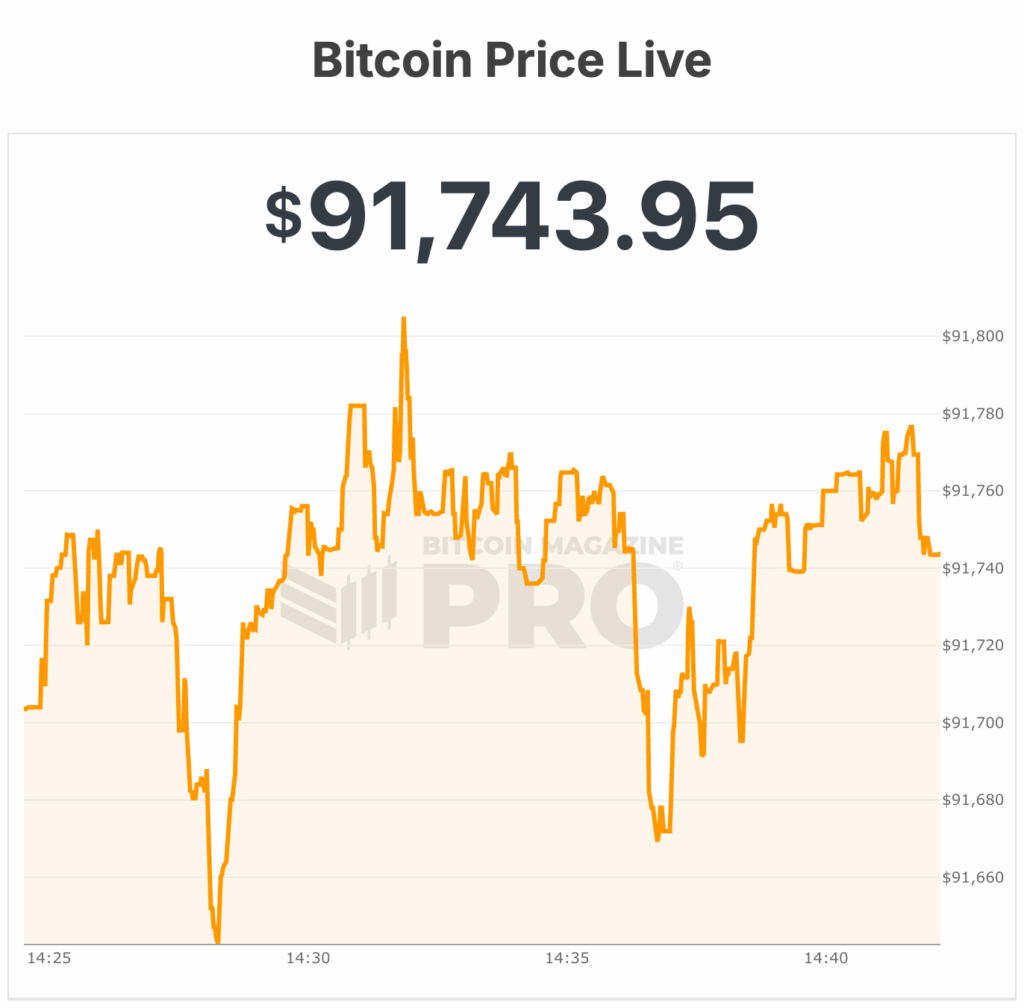

Bitcoin’s price showed notable movement over the past 48 hours following the news. Over the weekend and into Monday, the bitcoin price was fairly stale but jumped to the $91,000–$92,000 range, at the time of writing.

Bitcoin Magazine Pro data indicates the Bitcoin price reached an intraday high of roughly $92,400 between Sunday and Monday.

Across January 11–12, the Bitcoin price posted intraday gains of more than 0.5% on both days, signaling a gradual upward trend amid growing macroeconomic uncertainty.

Following the news, the bitcoin price appeared to be behaving more like safe-haven assets than typical risk instruments, with Bitcoin’s price moving independently of broader market weakness, suggesting traders were positioning the asset as a hedge amid concerns over the Fed’s independence and U.S. monetary policy shifts.

From a longer-term perspective, Bitcoin remains well below its record highs above $126,000 reached in early October 2025, having retraced significantly in recent months.

During the first week of January 2026, BTC mostly traded between $88,000 and $94,000, marking a consolidation range following late‑2025 weakness.

Where does the bitcoin price go from here?

Fresh Bitcoin Magazine analysis shows that Bitcoin’s price faced resistance at $94,000 last week, failing to sustain gains and closing at $90,891. Sunday’s doji candle signals indecision and a potential bearish reversal. Bulls appear weak, lacking the momentum to break through resistance, while bears have gained a slight edge heading into this week.

Key support levels are now at $87,000 and $84,000. Bears will attempt to push the Bitcoin price below $87,000, testing $84,000, and a break below could accelerate a decline toward the low $70,000 range.

Bulls may seek strength around the 0.618 Fibonacci retracement at $58,000 if supports fail. Resistance remains at $91,400 short-term and $94,000 long-term, with higher zones at $98,000–$103,500 and $106,000–$109,000.

This week, bears may pressure Bitcoin toward $87,000, while bulls will fight to maintain this support. A daily close below $87,000 would endanger $84,000 support, requiring significant buying to hold.

Looking ahead, price may remain range-bound between $84,000 and $94,000, with neither bulls nor bears in firm control. A close above $94,000 could trigger upward momentum, while a close below $84,000 could signal a deeper correction.

Overall, market sentiment leans bearish, with volatility likely in the near term, according to analysts.

The Bitcoin price right now is $91,749, with a 24-hour trading volume of 48 B. BTC is 1% in the last 24 hours. It is currently -1% from its 7-day all-time high of $92,356, and 2% from its 7-day all-time low of $90,129.

BTC has a circulating supply of 19,975,018 BTC and a max supply of 21,000,000 BTC. The global Bitcoin market cap today is $1,832,317,782,220, a 1% change from 24 hours ago.