The Senate Banking Committee postponed its planned markup of the Digital Asset Market CLARITY Act, capping what had been expected to be a pivotal week for U.S. crypto policy with an anticlimactic halt amid growing industry opposition and unresolved political disputes, according to reporting from Crypto in America.

The decision came after tensions escalated throughout the week as crypto companies and trade groups voiced frustration over late-stage amendments to the 278-page market structure bill.

Critics argued the changes tilted the legislation further in favor of banks and traditional finance, particularly by tightening restrictions around stablecoin rewards and tokenization.

Compounding the uncertainty, Democrats on the committee continued to press for stronger ethics provisions that would bar senior government officials — including the president — from personally profiting from crypto ventures. Those provisions have repeatedly stalled in negotiations with the White House, contributing to the impasse.

The immediate catalyst for the CLARITY Act postponement arrived around 4:00 p.m. Jan. 14, when Coinbase CEO Brian Armstrong announced that the exchange was withdrawing its support for the bill. Coinbase had been one of the most influential industry backers of a comprehensive market structure framework, investing heavily in lobbying efforts on Capitol Hill.

“We appreciate all the hard work by members of the Senate to reach a bipartisan outcome, but this version would be materially worse than the current status quo,” Armstrong wrote in a post on X. “We’d rather have no bill than a bad bill.”

In a follow-up post, Armstrong said he remained optimistic that lawmakers could still reach an acceptable compromise and pledged that Coinbase would continue engaging with policymakers on the CLARITY Act.

The withdrawal was a major setback. The loss of support from one of crypto’s most prominent policy voices risked signaling to undecided senators that the bill lacked sufficient industry consensus, raising the likelihood the committee would delay or abandon the markup altogether.

While the markup was ultimately postponed, Coinbase’s decision did not trigger a complete industry retreat. Several major firms and advocacy groups — including a16z, Circle, Paradigm, Kraken, Ripple, Coin Center, and the Digital Chamber — publicly reaffirmed their support for moving forward with a markup.

“It is easy to walk away when a process gets difficult,” Kraken co-CEO Arjun Sethi said in a post on X. “What is hard and what actually matters is continuing to show up, working through disagreements, and building consensus in a system designed to require it.”

In a brief statement announcing the postponement, Senate Banking Committee Chairman Tim Scott (R-SC) said that “everyone remains at the table working in good faith,” but he did not offer a new date for the markup or specify which issues would need to be resolved before it could be rescheduled.

The Senate is out of session next week for the Martin Luther King Jr. Day recess and is set to return the following week.

The Senate Agriculture Committee, which shares jurisdiction over parts of the bill — particularly spot market oversight and the Commodity Futures Trading Commission’s role — is expected to hold its own markup on the CLARITY Act later this month after postponing an earlier session.

It remains unclear whether Banking’s delay will affect Agriculture’s timeline.

What is the CLARITY Act?

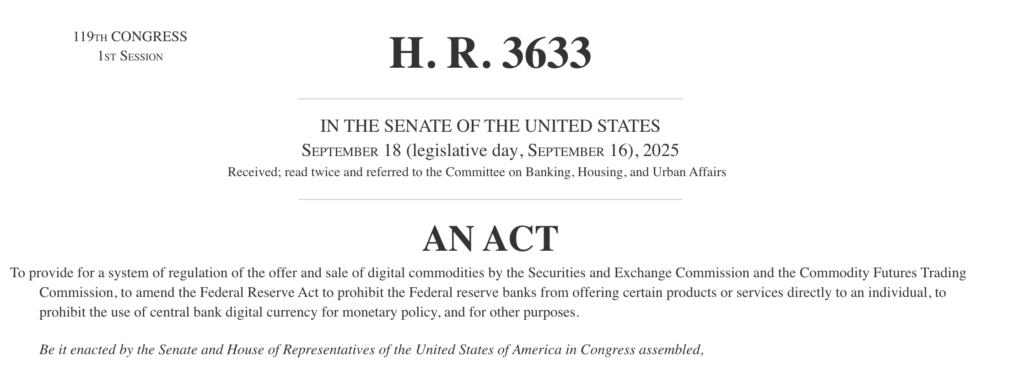

The CLARITY Act, which uses House-passed H.R. 3633 as its base text, is designed to establish a comprehensive federal framework for digital asset markets.

The legislation seeks to divide oversight between the Securities and Exchange Commission and the CFTC, set standards for payment stablecoins, clarify rules for decentralized finance, and protect software developers who do not control customer funds.

Supporters, primarily Republicans, argue the bill would replace regulatory uncertainty with clear rules, strengthen anti-fraud and illicit finance authorities, and bring crypto activity back onshore. Committee fact sheets describe it as the “strongest illicit finance framework Congress has ever considered” for digital assets.

Critics, however, contend the bill weakens investor protections and risks creating new loopholes.

Former SEC Chief Accountant Lynn Turner warned earlier this week that the CLARITY Act draft lacks Sarbanes – Oxley–level safeguards, such as mandatory audited financial statements, internal control certifications, and robust Public Company Accounting Oversight Board oversight — deficiencies he said could enable another FTX-style collapse.

Stablecoin rewards have emerged as one of the most contentious issues in the CLARITY Act. Banking groups argue that yield-bearing stablecoins could siphon deposits from traditional banks, while crypto firms counter that broad bans on rewards would stifle innovation and push users toward offshore platforms.