Bitcoin’s Tuesday slide to $87,895 has revived a familiar market habit: attaching a single, clean narrative to messy positioning, flows, and reflexive price action. This time, the culprit making the rounds is quantum computing, a potentially “existential threat” that’s supposedly explaining Bitcoin’s underperformance versus gold which has printed a new all-time high at $4,888.

The quantum angle picked up steam after a post by Nic Carter, a partner at Castle Island Ventures. Carter wrote: “Bitcoin’s “mysterious” underperformance (due to quantum) is the only story that matters this year. The market is speaking the devs aren’t listening,” and shared a tweet about the news that Wall Street strategist Christopher Wood removed a 10% Bitcoin allocation from a model portfolio due to concerns that quantum computing could undermine Bitcoin’s long-term value proposition.

Is Bitcoin Falling On Quantum Fears?

Not everyone buying the premise is buying the price-action conclusion. Well-known Bitcoin advocate Vijay Boyapati, while acknowledging quantum computing as a real issue, pushed back on using it as the primary explanation for why Bitcoin is stalling and selling off.

Related Reading

“While I agree QC is a legitimate concern… I think the price stalling invites narratives to fill the explanatory void when, imo, the real explanation is really just the unlocking of an enormous supply once we hit a magic number for a lot of whales (100k),” Boyapati wrote. “Prices increasing are like waves hitting a glacier – eventually a chunk of supply breaks off and crashes onto the order books.”

Boyapati’s broader point is that market structure can do plenty of damage on its own once a big level triggers distribution and confidence cracks.

“Given the path dependent nature and feedback loops involved in a bull run sustained on narratives… the price stalling then causes people to doubt that Bitcoin will continue to go up and this then results in more selling until you get an equilibrium of supply and demand at some lower price point,” he added. “This is what happens during Bitcoin bear markets – and I think we’re in one.”

James Check, a prominent Bitcoin on-chain analyst, co-founder of Check on Chain, and former Lead Analyst at Glassnode, largely sided with the view that quantum risk may be a background constraint on some capital, but not the dominant driver of the gold-versus-Bitcoin divergence.

Related Reading

“QC keeps some capital away, but this argument that gold is up and Bitcoin is down because of it just isn’t it,” he wrote. “Gold has a bid because sovereigns are buying it in place of treasuries. The trend has been in place since 2008, and accelerates after Feb-22.”

He also highlighted the supply-side pressure Bitcoin has already absorbed. “Bitcoin saw sell-side from HODLers in 2025 which would have killed every prior bull thrice over, and then once more,” Checkmate said. The policy takeaway, in his view, is practical but limited: quantum preparedness matters, but attributing every downturn to it doesn’t help traders understand what’s actually clearing the market.

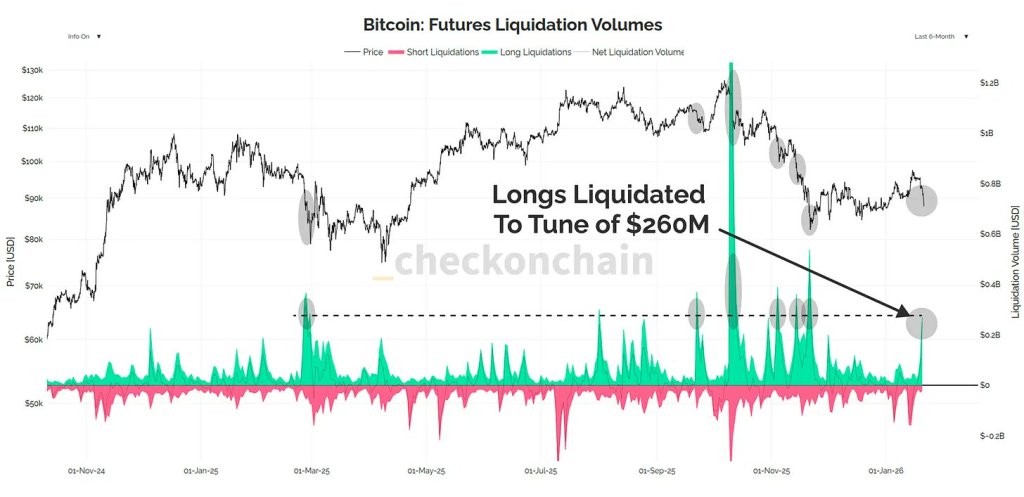

In a short market update posted via Checkmate’s analytics brand Checkonchain, the immediate trigger for the move was described in leverage terms rather than existential risk. Bitcoin “sold back down into the high $80ks,” with “the bears taking a bunch of leveraged long traders out to the woodshed,” the note said, estimating that around $260 million in leveraged long exposure was wiped.

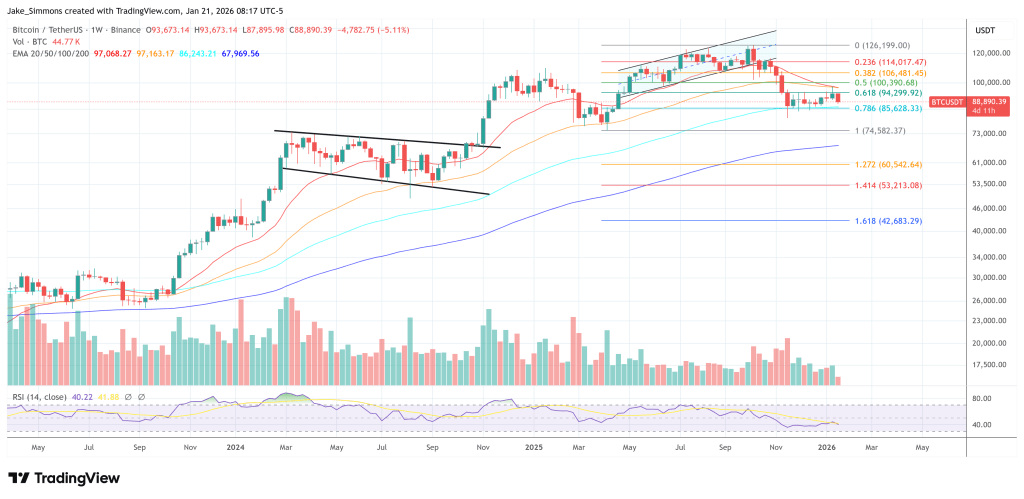

Technically, the desk framed the structure as still resembling a bear flag, with a “clear supply air-pocket” between $70,000 and $81,000, language that points to thin bid support if sellers regain control.

At press time, BTC traded at $88,890.

Featured image created with DALL.E, chart from TradingView.com